colorado real estate taxes

You must apply by July 15 of the year in which you seek an exemption. Due by the last day of February is the payment deadline for the first half and by June is the deadline for the second half.

Colorado Property Tax Calculator Smartasset

Factoring in population growth and the distribution of property tax burden that translates to a property tax increase of more than 20 for the average property owner the study said.

. So if you pay 1500 in taxes annually and your homes market value is 100000 your effective tax rate is 15. Colorado is ranked number thirty out of the fifty states in order of the average amount of property taxes collected. For example if you want to search for a property owner with the last name Jones you may enter JO.

We are located on the first floor of the County Courthouse at 215 W. By December 31st 999 of all taxes will be collected. A tax of 10 mills on a property with an assessed value of 10000 is equal to 100 10000 x 01.

Three cities in Colorado also have a local. The Eagle County Treasurers Office strives to provide the public with accurate and up-to-date. 2021 Tax Statements due in 2022 will be mailed mid January 2022.

30 2021 otherwise the delinquency will be advertised in The Denver Post for three consecutive weeks in mid-Sept. No state exemptions are allowed. What is the Property TaxRentHeat Credit rebate PTC Rebate.

The assessment rate on residential properties in Colorado is estimated at 796 use 0796 in the above equation. 10th St Pueblo CO 81003. Below we have highlighted a number of tax rates ranks and measures detailing Colorados income tax business tax sales tax and property tax.

The Last Name field MUST contain a partial or complete last name. Tax amount varies by county. How does Colorado rank.

Get all the information you need for Real Estate Delinquent Taxes Tax Lien Sales. Our office hours are 8 am to 430 pm Monday through Friday except legal Holidays or. 27 2021 or made online before Aug.

By June 30th each year the Treasury Division collects about 95 of all taxes billed. Over the same period the statewide assessed value of residential property is projected to jump 385 from 71 billion to 983 billion. 13 rows Colorado has a flat income tax rate of 450.

In 2022 the Treasurer and Public Trustees Office will collect the 2021 taxes. You may enter only the beginning letters of the last name. ON-LINE PROPERTY TAX PAYMENT.

Unsure Of The Value Of Your Property. The Treasurers Office is responsible for the collection of all real estate personal property manufactured housing and state assessed taxes. Property Owner Address Change.

Property tax rates are set by each county. A 10 advertising fee will. Property taxes owed must be received by Aug.

The assessment rate on non-residential properties is fixed by law at 29 use 29 in the above equation. The search will give you all parcel numbers where the owners last name starts with the letters JO. Value of the Property x Assessment Rate x Mill Levy Property Tax Owed.

If you are a full-year Colorado resident who is 65 years of age or older a surviving spouse 58 years of age or older or disabled regardless of age you may qualify. Property taxes are collected one year in arrears. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone.

The Treasurers Office collects taxes for real property mobile homes and business personal property. The Property and Taxes center is the place to find the main areas for residents to find information they need from multiple Jefferson County departments divisions and elected offices on both property and what is needed for taxes. Select a tax type below to view the available payment options.

Each tax type has specific requirements regarding how you are able to pay your tax liability. As of April 30 tax payments made in a lump-sum amount must be made in full if they are made as a lump sum. If you do not receive your bill by the end of January please contact us at 970-328-8860 to confirm your mailing address and request a replacement copy.

Property Taxes and Property Tax Rates. However the federal unified credit reduces the federal estate tax liability and therefore can affect the state tax liability. The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans.

Senior Tax Worker Program. An effective tax rate is the amount you actually pay annually divided by the value of your property. Ad Property Taxes Info.

The mill levy is the tax rate set each year by each taxing authority such as school. The median property tax in Colorado is 143700 per year for a home worth the median value of 23780000. A property tax exemption is available for senior Colorado residents or surviving spouses provided they meet the requirements.

The first step towards understanding Colorados tax code is knowing the basics. Find All The Record Information You Need Here. When Are Colorado Real Estate Taxes Due.

Every January mail is sent out the property tax statements. Counties in Colorado collect an average of 06 of a propertys assesed fair market value as property tax per year. The Colorado estate tax is calculated as the share of the estate that includes Colorado property multiplied by the state death tax credit.

Property Tax Search - Pay. Excise Fuel Tax. Colorado charges sales taxes from 29 to 15.

Sales Use Tax. Oak Street Fort Collins CO 80521 Map of Facilities 970 498-7000 Contact Us Our Guiding Principles. A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000 in the actual value of their primary residence is exempted from property taxation The state pays the exempted portion of the property tax The Property Tax Exemption for seniors and one.

Senior Property Tax Exemption.

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals Faegre Drinker Biddle Reath Llp Jdsupra

Who Pays The Highest Property Taxes Property Tax Real Estate Tips Denver Real Estate

Assessor Douglas County Government

Assessor Douglas County Government

Colorado Property Tax Calculator Smartasset

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Colorado Property Tax Calculator Smartasset

Real Estate Property Tax Jackson County Mo

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Everything You Need To Know Smartasset

Assessor Douglas County Government

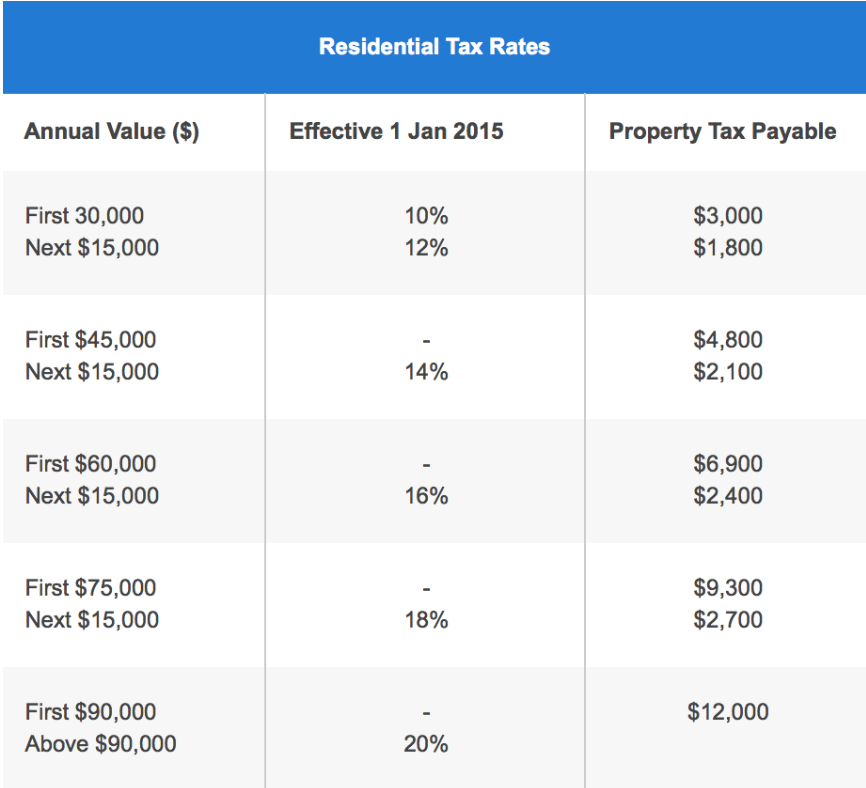

Property Tax For Homeowners In Singapore How Much To Pay Rebates Deadline

Property Taxes How Much Are They In Different States Across The Us

How Taxes On Property Owned In Another State Work For 2022

/RealEstateTaxesvs.PropertyTaxesJune102021-1472d05f98994af18068805fb526b19b.jpg)

Real Estate Taxes Vs Property Taxes

Adding Someone To Your Real Estate Deed Know The Risks Deeds Com

Flip Tax In New York Real Estate Who Pays Them

Colorado Estate Tax Everything You Need To Know Smartasset

First Time Home Buyer Vocab Cheat Sheet Lou Realty Group Real Estate Marketing Plan Real Estate Quotes Real Estate Fun